One of the best ways to get to a point where you can save more than a few bucks every week is to start eliminating debt. You might have a few thousand dollars in credit cards, or you could have several hundred thousand dollars in other liabilities that you owe. It often seems as though you can't get that debt down, no matter what you do, because it just seems like a lot. But, you can quickly eliminate debt by knowing how to manage that debt.

Know Your Debt

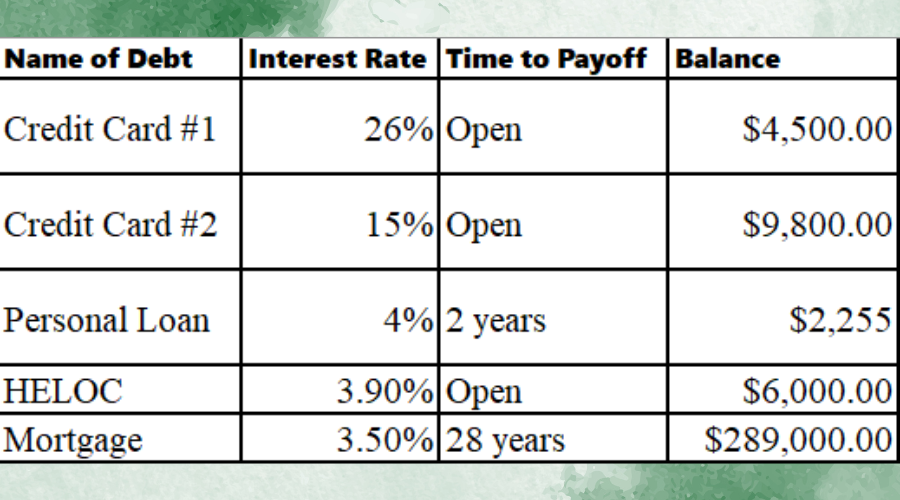

Before you can effectively manage your debt, you need to know everything about it. Create a list or a spreadsheet with all of your debt. Create three columns: Interest Rate, Length of Time of Loan/Debt, and Balance. Sort the list by interest rate, putting the highest interest rate at the top. If two of the loans have the same interest rate or are nearly the same, list the one with the shortest amount of time to pay off first.

Once you create a table and organize your debts, you can easily see which debt is costing you the most. That is the debt you need to pay off first. With the amount of online shopping people do, and for other reasons, everyone should have at least one credit card. If you can manage with just one, get rid of the credit card with the highest interest rate. If you need two, replace high-interest rate cards with those that have lower rates as you pay off the original accounts.

In this case, the credit card with the highest amount has a lower balance than the credit card with the lower amount, which means that you could pay it off even faster. If your normal payment is $125 and you normally pay $200 – you should never pay just the minimum – increase the monthly payment, if you can – to $250. You can also transfer the amount to the card with the lower interest rate or use your HELOC to pay it off.

If your only choice is to pay it off by adding to the monthly payment, make sure you don't put anything else on that card. Once you pay it off, then you can look for a credit card with a lower interest rate.

Paying Off Personal Loans and Other Small Loans

Before you consider adding extra money to loan payments, be sure you know how those loans work. Mortgages usually use compound interest, so it is not mentioned in this section.

Simple Interest

If the loan is a simple interest loan, you can pay extra every month, and your principal and interest will decrease. Always make sure that your loan does not have a pre-payment penalty for paying early. If it does, you're not saving much by paying the loan off early.

Pre-Computed Interest

If your loan has a pre-computed interest rate, it doesn't matter how much extra you pay – your payments will remain the same, and your interest rate won't decrease. In this case, you need to set aside the amount you would pay every month, preferably in a high-yield savings account. As you are saving money to pay off the loan in a lump sum, it will gather interest for you.

When you believe you have enough to pay off the loan, call the bank or entity that holds the loan and ask for the payoff. If you have enough saved, you can then pay off the loan and save on the interest. As with simple interest loans, be sure the loan does not have a pre-payment penalty.

Add to Savings

Once you pay off the first credit card, increase the second card's payment by the extra amount of the first card's payment. Deposit the minimum payment amount from the first card into your high-yield savings account. For example:

Credit Card #1 Minimum Payment: $125.00

Amount of Extra Payment: $250.00

Total Monthly Payment of Credit Card #1: $375.00 (now paid off)

Pay $250.00 as an extra payment on Credit Card #2 – over and above the extra payment you already make since you never pay just the minimum – on the second card.

If Credit Card #2 has a minimum payment of $200 and you normally pay $300, your new payment would be $550.00.

Deposit $125.00 per month into your high-interest savings account. This amount is the original minimum payment on the first credit card. While you could put it on the second credit card to pay it off faster, the goal here is to pay off debt quickly while saving money.

If possible, hold off on opening a new, low-interest credit card until you get Credit Card #2 paid off. If you cannot, then keep that balance at a minimum and use some of the money you would put in the savings account to make that payment. Keep that balance as low as possible, or try not to use that card until you get all other debt except your mortgage paid off.

Paying Off Other Loans

Once you get your credit cards paid off, you may have enough in savings to pay off smaller personal loans or car loans. If you can do that while still keeping an emergency buffer of at least two months' bills and groceries, then use that money to pay off the smaller loans.

If you do not have a large enough backup in savings, and your personal loans or car loans are computed using simple interest, you can continue the method used for paying off credit cards to pay off your personal loans.

Paying Off Your Mortgage Early

Before you pay off your mortgage early, you must know where you are in life. If you plan on moving within a few years, then you should put the extra money in savings instead of on the mortgage, since you won't save much by putting the extra money on the monthly mortgage payments.

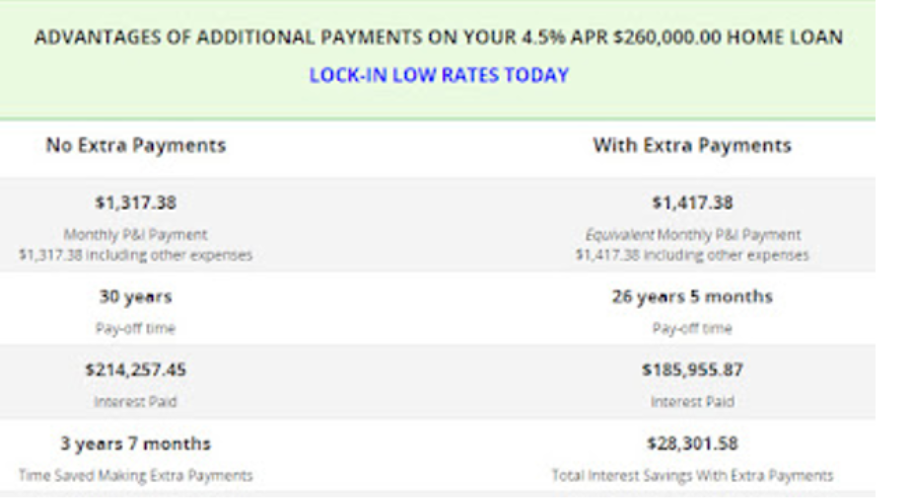

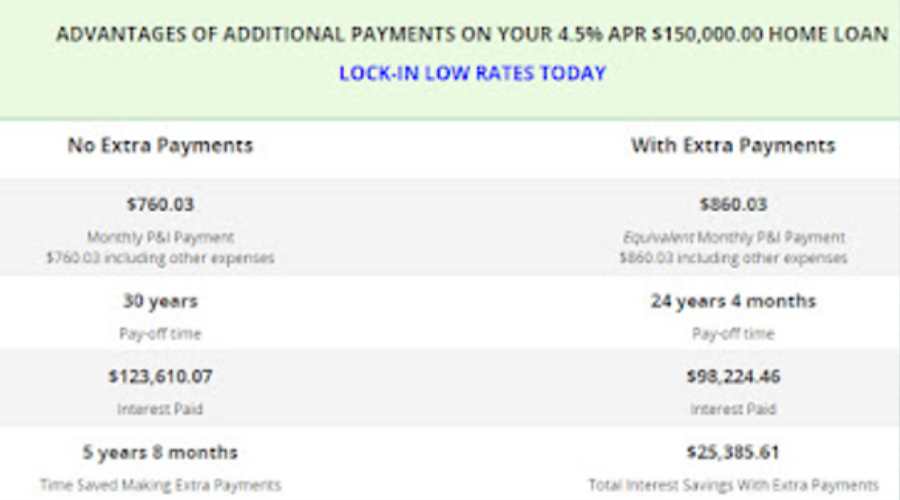

If you plan on staying in the home for many years – usually 10 or more, then you could significantly save on interest by making extra payments on the principal. Even putting $100 on the principal every month can drop your monthly payment by several years.

As you can see, the amount of interest you save depends on the amount of money you borrowed. You can enter your own calculations at Mortgage Calculator to see how much you can save on your loan. Try entering different amounts to see how soon you can make your payoff date.

Why Not Just Refinance?

The simple answer is that refinancing costs money. If you don't plan on staying in your home long enough, refinancing could actually cost you more money. You'll have to have the cash to refinance or add the costs of refinancing into your loan, which means that you'll pay interest on it. You also have to calculate your break-even point. You won't realize any savings until you pass the break-even point. When you add money to the principal every month, you're saving on the back end of the loan by shortening the loan and decreasing the amount of interest you pay over the life of the loan.

Happy Saving!

Comments