You may want to put money away every week but can't manage it. Whether you believe you have to put hundreds away or you think you can't do without even $50 per week, there is still a way. You can put as little as $10 into a savings account each week. Create a savings plan and deposit what you believe you can afford. For now. After a couple of weeks, you won't even miss the money, especially if you set up an automatic transfer.

What Is a High-Yield Savings Account?

Some financial institutions offer high-yield savings accounts. These accounts have a higher interest rate than traditional savings accounts. In most cases, you'll find high-yield savings accounts at online banks or credit unions. The rates can be several times higher than typical brick-and-mortar banks.

For example, a savings account at Regions Bank is paying 0.01 percent as of the first quarter of 2024, whereas a Capital One high-yield savings account is paying 4.35 percent. That is a significant difference.

How Does a High-Yield Savings Account Work?

A high-yield savings account works just like any other savings account, except you get paid a higher interest rate, which allows your money to grow faster. In the example above, $1,000 will get you about $0.10 in one year with an interest rate of 0.01 percent if you don't add anything else to the account during the year. If you deposit $40 per month, you'll earn about $0.12 interest per year.

With a high-yield interest account paying 4.35 percent, your $1,000 will grow by $43.52 per year without adding anything else to the account. If you deposit $40 per month, it will grow by $53.86 in a year.

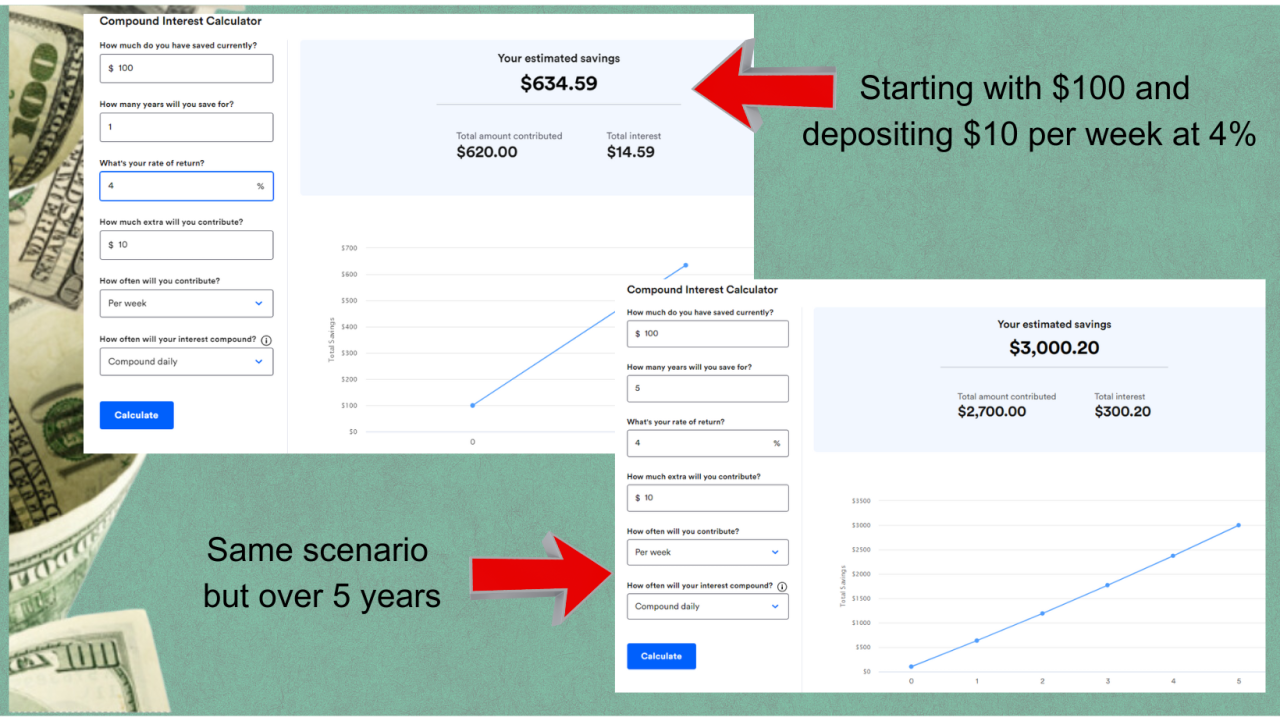

If you can deposit money weekly instead of monthly, even if it's only $10 per week, your money will grow even faster, even though you are essentially depositing the same amount. The $10 you deposit at the beginning of the month has all month to accumulate interest, whereas the $40 you deposit all at once doesn't have the extra time to earn interest that the weekly deposits have.

Another feature of high-yield savings accounts is that many of them do not have a monthly fee and / or do not require a minimum balance. While that monthly fee may not seem like anything, it is usually more than the interest you earn until you can build your account.

The Trick to Saving

First, you need a savings account that gets you excited. Accounts at regular banks pay very little interest, if at all. High-yield savings accounts pay over the partial percentage you might get at a regular bank.

Start with something that you feel comfortable with. If it's just $5 per week, then deposit $5. If you are still arguing with yourself about putting some money away because you can't figure out where you're going to get it from, think about the things you buy that you want instead of need. Do you go to the coffee shop at least once each week? You can sock that $5 away by making your own coffee.

Once you get into the mindset of saving, it gets easier and easier. Make sure you pick the same day every week to make the transfer so that it is easier to remember. After a few weeks, you won't even miss that $5, and you could be ready to increase the amount – even if it's by $1.

The Benefits of a High-Yield Savings Account

Investing in a high-yield savings account has many benefits, even if you have to start small – with less than $100. The benefits include:

- Higher interest rates, which means your money grows faster.

- The accounts are FDIC-insured or NCUA-insured up to the maximum (always be sure to choose a bank that is insured).

- You have easy access to funds – they are just a transfer away.

- Many have no fees or minimum deposits required.

Is a High-Yield Savings Account Right for You?

While a high-yield savings account offers many benefits, it might not be the best option for everyone. If you are looking to make your money grow as much as possible, it is the best option. However, if you prefer having your money in a physical bank close to where you live, it may not be the best option for you.

If you choose a high-yield savings account, compare several banks for interest rates, fees, minimum deposits and other features. Choose the bank that best meets your needs. Since you are interested in saving as much as possible, accounts that have fees and minimum deposits are probably not good options.

A high-yield savings account can be a valuable tool because it offers higher returns on your savings without sacrificing accessibility or safety.

Comments